Table of Contents

For the first time in seven years, the West Bengal government has made a major change to property circle rates in and around Kolkata. Effective immediately, these rates have been revised upwards by a significant margin, ranging from 15% to a staggering 90% in some areas. This change is a big deal for anyone looking to buy or sell property in the city, as it will directly affect how much you pay in taxes.

What Is a Circle Rate, Anyway?

In simple terms, a circle rate is the minimum value the government sets for a property when a sale is registered. Think of it as a baseline price. Stamp duty and registration fees-the taxes you pay to make a property transaction official-are calculated based on this rate or the actual sale price, whichever is higher. So, when the circle rate goes up, your upfront costs to buy a home also go up.

The Big Changes: Where Rates Shot Up

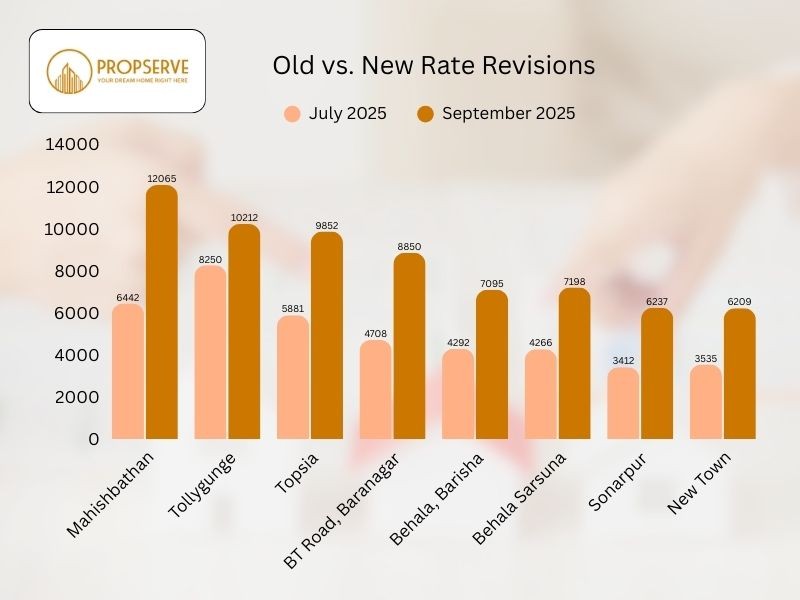

The government’s revision was not a small tweak; it was a major overhaul, especially in certain areas. For example, the circle rate in Mahishbathan, a growing area near Salt Lake, jumped by 87% to ₹12,065 per square foot. In BT Road, Baranagar, a hub for new housing projects, the rate almost doubled, increasing by 88% to ₹8,850 per square foot.

Other areas also saw significant increases:

- Topsia: 67% increase to ₹9,852 per sq ft.

- Behala Sarsuna: 69% increase to ₹7,198 per sq ft.

- New Town: 76% increase to ₹6,209 per sq ft.

Why Did the Government Do This?

According to finance department sources, the main reason for the hike was the large and growing gap between the old, outdated circle rates and the real market prices of properties. An official explained that in some cases, properties were being sold at ₹9,000 per sq ft while the official rate was only ₹6,000 per sq ft. The government hopes this new policy will close that gap and bring in more revenue from stamp duty and registration fees.

What This Means for You, the Buyer

The most immediate impact for homebuyers is a higher total cost. The increase in circle rates means you will pay more in stamp duty and registration fees. In Kolkata and other urban areas, the stamp duty is 6% for properties valued below ₹1 crore and 7% for those above. This revision will push many three-bedroom and even some two-bedroom units over that crucial ₹1 crore mark, automatically moving them into the higher stamp duty bracket.

The real estate industry has voiced strong concerns about this move. Credai West Bengal president Sushil Mohta warned that in some areas, the new circle rates are now higher than the actual market prices.This creates a complicated tax problem for both buyers and sellers, as income tax becomes due on the difference between the lower transaction price and the higher official rate. Saket Mohta, managing director of Merlin Group, stated that this mismatch could make it a “challenge to conclude transactions” and might eventually hurt the government’s revenue if sales slow down.

The Silver Lining: A Balanced View

Not everyone in the industry believes the hike will be a disaster. Vivek Rathi, National Director at Knight Frank India, offers a more optimistic outlook. He points to the impressive resilience of the Kolkata market, which saw home registrations grow by a significant 37% year-on-year between January and August 2025. This happened even after a previous pandemic-era stamp duty rebate was withdrawn.

Rathi believes this proves that buyer decisions are mostly driven by market prices, affordability, and the strong desire for homeownership, rather than just the official rates. He expects the hike to have only a “limited impact on sales volumes” in the long run.

Conclusion

The West Bengal government’s decision to hike circle rates is a significant event with clear goals: to align property values with market reality and boost state revenue. While it will definitely lead to higher costs for buyers and new tax issues for sellers in some areas, the ultimate impact on the market’s long-term health will depend on its underlying strength. The coming months will show if Kolkata’s property market, buoyed by strong homebuyer sentiment and consistent growth, can absorb this change and continue its upward momentum.

The Propserve Guide: Navigating Kolkata’s New Circle Rates & Tax Realities Frequently Asked Questions (FAQ)

How exactly does a circle rate hike increase my property cost?

The circle rate is the minimum value the government uses to calculate Stamp Duty and Registration Fees. In Kolkata, if the circle rate for your area increases by 50%, the mandatory taxes you pay at the sub-registrar’s office will increase proportionally, even if the actual price you paid the developer hasn’t changed.

What happens if the circle rate is higher than the market price?

This is a critical concern in 2026. If you buy a property below the official circle rate, Section 56(2)(x) of the Income Tax Act may apply. The government considers the difference between the lower purchase price and the higher circle rate as “Income from Other Sources,” meaning both the buyer and the seller could face additional income tax liabilities on that “hidden profit.”

Are there any rebates currently available for Kolkata home buyers?

As of February 2026, the previous pandemic-era stamp duty rebates have been withdrawn. However, it is always worth checking the official WB Registration portal for any specific municipal or green-building incentives. At Propserve, we stay updated on daily government circulars to ensure our clients never miss a potential saving.

Which areas in Kolkata saw the highest circle rate revisions?

Developing hubs and IT corridors saw the most significant jumps. Mahishbathan (near Salt Lake) and BT Road (Baranagar) experienced hikes of nearly 85-90%. These revisions aim to close the gap where market prices had far outpaced the government’s 7-year-old baseline.

Will this hike lead to a drop in property prices in Kolkata?

Historical data shows that the Kolkata market is highly resilient. Despite the hike, registration volumes in early 2026 remain steady. While the “upfront” tax cost is higher, the underlying demand for homeownership in areas like New Town and Joka continues to drive the market forward.

How can I check the latest circle rate for my specific plot?

You can check it online via the West Bengal Registration Department (wbregistration.gov.in). You will need your District, Police Station, and Mouza details. Alternatively, you can contact the Propserve Investment Team, and we will provide you with a detailed “Cost to Register” breakdown for any property you are considering.

Reference Links:

- First property circle rate hike for Kolkata in seven years to push up registration fee, stamp duty – The Times of India, accessed on September 20, 2025,https://timesofindia.indiatimes.com/city/kolkata/first-property-circle-rate-hike-for-kolkata-in-seven-years-to-push-up-registration-fee-stamp-duty/articleshow/123960137.cms

- Circle Rates In West Bengal Increase By Up To 90%, Housing Costs Climb – Times Property, accessed on September 20, 2025,

https://timesproperty.com/news/post/circle-rates-in-west-bengal-increases-by-up-to-90-pc-blid10578 - Circle Rate in Kolkata 2025: Area-Wise Categorization List – Square Yards, accessed on September 20, 2025, https://www.squareyards.com/blog/circle-rate-in-kolkata-crc

- First property circle rate hike for Kolkata in seven years to push up registration fee, stamp duty, accessed on September 20, 2025, https://timesofindia.indiatimes.com/city/kolkata/trina-banerjee-via-timesinternet-in-attachments206am-4-hours-agoto-toi-city-bijufirst-property-circle-rate-hike-for-kolkata-in-seven-years-to-push-up-registration-fee-stamp-duty/articleshow/123960137.cms

- Stamp Duty and Registration Charges in West Bengal 2025 – MagicBricks, accessed on September 20, 2025, https://www.magicbricks.com/blog/stamp-duty-and-registration-charges-in-west-bengal/118412.html

- Understanding Section 56(2)(x) of the Income Tax Act | Bajaj Finance, accessed on September 20, 2025, https://www.bajajfinserv.in/what-is-section-56-2-x-of-the-income-tax-act