For the first time in seven years, the West Bengal government has made a major change to property circle rates in and around Kolkata. Effective immediately, these rates have been revised upwards by a significant margin, ranging from 15% to a staggering 90% in some areas. This change is a big deal for anyone looking to buy or sell property in the city, as it will directly affect how much you pay in taxes.

What Is a Circle Rate, Anyway?

In simple terms, a circle rate is the minimum value the government sets for a property when a sale is registered. Think of it as a baseline price. Stamp duty and registration fees-the taxes you pay to make a property transaction official-are calculated based on this rate or the actual sale price, whichever is higher. So, when the circle rate goes up, your upfront costs to buy a home also go up.

The Big Changes: Where Rates Shot Up

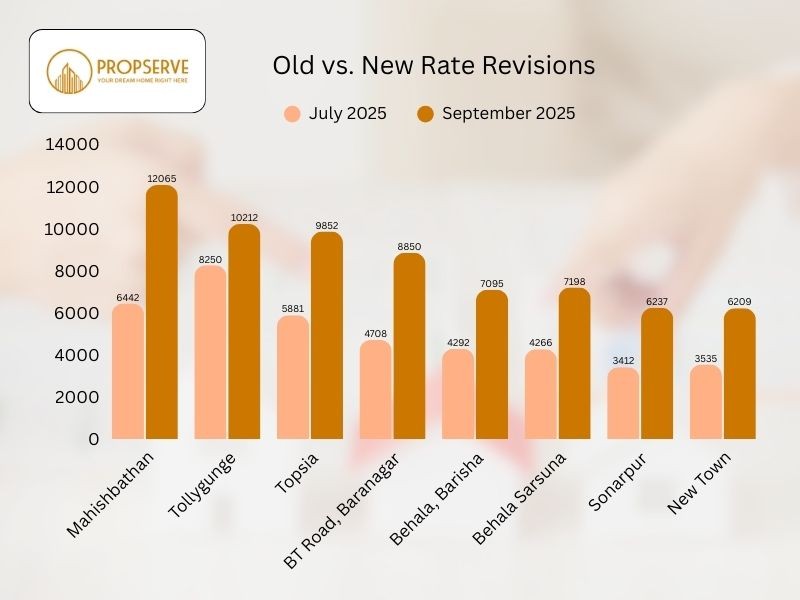

The government’s revision was not a small tweak; it was a major overhaul, especially in certain areas. For example, the circle rate in Mahishbathan, a growing area near Salt Lake, jumped by 87% to ₹12,065 per square foot. In BT Road, Baranagar, a hub for new housing projects, the rate almost doubled, increasing by 88% to ₹8,850 per square foot.

Other areas also saw significant increases:

- Topsia: 67% increase to ₹9,852 per sq ft.

- Behala Sarsuna: 69% increase to ₹7,198 per sq ft.

- New Town: 76% increase to ₹6,209 per sq ft.

Why Did the Government Do This?

According to finance department sources, the main reason for the hike was the large and growing gap between the old, outdated circle rates and the real market prices of properties. An official explained that in some cases, properties were being sold at ₹9,000 per sq ft while the official rate was only ₹6,000 per sq ft. The government hopes this new policy will close that gap and bring in more revenue from stamp duty and registration fees.

What This Means for You, the Buyer

The most immediate impact for homebuyers is a higher total cost. The increase in circle rates means you will pay more in stamp duty and registration fees. In Kolkata and other urban areas, the stamp duty is 6% for properties valued below ₹1 crore and 7% for those above. This revision will push many three-bedroom and even some two-bedroom units over that crucial ₹1 crore mark, automatically moving them into the higher stamp duty bracket.

The real estate industry has voiced strong concerns about this move. Credai West Bengal president Sushil Mohta warned that in some areas, the new circle rates are now higher than the actual market prices.This creates a complicated tax problem for both buyers and sellers, as income tax becomes due on the difference between the lower transaction price and the higher official rate. Saket Mohta, managing director of Merlin Group, stated that this mismatch could make it a “challenge to conclude transactions” and might eventually hurt the government’s revenue if sales slow down.

The Silver Lining: A Balanced View

Not everyone in the industry believes the hike will be a disaster. Vivek Rathi, National Director at Knight Frank India, offers a more optimistic outlook. He points to the impressive resilience of the Kolkata market, which saw home registrations grow by a significant 37% year-on-year between January and August 2025. This happened even after a previous pandemic-era stamp duty rebate was withdrawn.

Rathi believes this proves that buyer decisions are mostly driven by market prices, affordability, and the strong desire for homeownership, rather than just the official rates. He expects the hike to have only a “limited impact on sales volumes” in the long run.

Conclusion

The West Bengal government’s decision to hike circle rates is a significant event with clear goals: to align property values with market reality and boost state revenue. While it will definitely lead to higher costs for buyers and new tax issues for sellers in some areas, the ultimate impact on the market’s long-term health will depend on its underlying strength. The coming months will show if Kolkata’s property market, buoyed by strong homebuyer sentiment and consistent growth, can absorb this change and continue its upward momentum.

Reference Links:

- First property circle rate hike for Kolkata in seven years to push up registration fee, stamp duty – The Times of India, accessed on September 20, 2025,https://timesofindia.indiatimes.com/city/kolkata/first-property-circle-rate-hike-for-kolkata-in-seven-years-to-push-up-registration-fee-stamp-duty/articleshow/123960137.cms

- Circle Rates In West Bengal Increase By Up To 90%, Housing Costs Climb – Times Property, accessed on September 20, 2025,

https://timesproperty.com/news/post/circle-rates-in-west-bengal-increases-by-up-to-90-pc-blid10578 - Circle Rate in Kolkata 2025: Area-Wise Categorization List – Square Yards, accessed on September 20, 2025, https://www.squareyards.com/blog/circle-rate-in-kolkata-crc

- First property circle rate hike for Kolkata in seven years to push up registration fee, stamp duty, accessed on September 20, 2025, https://timesofindia.indiatimes.com/city/kolkata/trina-banerjee-via-timesinternet-in-attachments206am-4-hours-agoto-toi-city-bijufirst-property-circle-rate-hike-for-kolkata-in-seven-years-to-push-up-registration-fee-stamp-duty/articleshow/123960137.cms

- Stamp Duty and Registration Charges in West Bengal 2025 – MagicBricks, accessed on September 20, 2025, https://www.magicbricks.com/blog/stamp-duty-and-registration-charges-in-west-bengal/118412.html

- Understanding Section 56(2)(x) of the Income Tax Act | Bajaj Finance, accessed on September 20, 2025, https://www.bajajfinserv.in/what-is-section-56-2-x-of-the-income-tax-act